Guideline on Common Financial Management Business Process 3.3 - Manage Other Payments

Executive Summary

This guideline is part of a set of guidelines designed to assist departments See footnote [1] in implementing common financial management business processes.

This guideline presents the “should be” model for Manage Other Payments, which involves those common See footnote [2] payment transactions not covered by Manage Interdepartmental Settlements (Business Process 2.2), Manage Procure to Payment (Business Process 3.1), Manage Travel (Business Process 3.2), Pay Administration (Business Process 5.1), and Manage Grants and Contributions (Business Process 6.1). This guideline describes roles, responsibilities and recommended procedures in the context of the Financial Administration Act (FAA), other legislation, and Government of Canada policy instruments. Familiarity with Manage Procure to Payment (Business Process 3.1) is highly recommended prior to reading this business process.

The following categories of common payment transactions are covered in this guideline.

Other operational payments result in charges against appropriations and include awards, honoraria, ex gratia payments, repayable loans, employee reimbursements, returns as described in section 20 of the FAA, accountable advances (excluding travel advances, which are covered in Manage Travel (Business Process 3.2)), and imprest funds. These payments do not use a purchase order to initiate a transaction and do not follow a formal procurement process.

Legal payments also result in charges against appropriations and include settlements, claims against the Crown, and nugatory payments. These transactions are triggered by a court or a tribunal decision rather than by a program requirement. Because these transactions do not involve the acquisition of goods or services, there is no procurement process. A legal opinion and documentation, such as the copy of the court or tribunal decision, are required before the payment can be made.

Payments not impacting appropriations are made out of the Consolidated Revenue Fund and include garnishments, other deductions, remittances of taxes collected, payments against imprest funds, repayment of contractor holdbacks, and some types of payments against specified purpose accounts. See footnote [3] Although these transactions do not result in charges against appropriations and there is no acquisition of goods or services, FAA certification and payment authority are still required.

Periodic payments are recurring (usually monthly) payments resulting from a multi-year agreement established under Manage Procure to Payment (Business Process 3.1), starting with the second and subsequent payments of the agreement. These payments can be a fixed amount (for example, leases and rent) or usage-based (for example, telecommunications, utilities and taxis) and result in charges against appropriations. There is no need to identify the requirements or to obtain expenditure initiation authority. Some organizations may conduct a reallocation exercise, to ensure that the costs are properly attributed to responsibility centres.

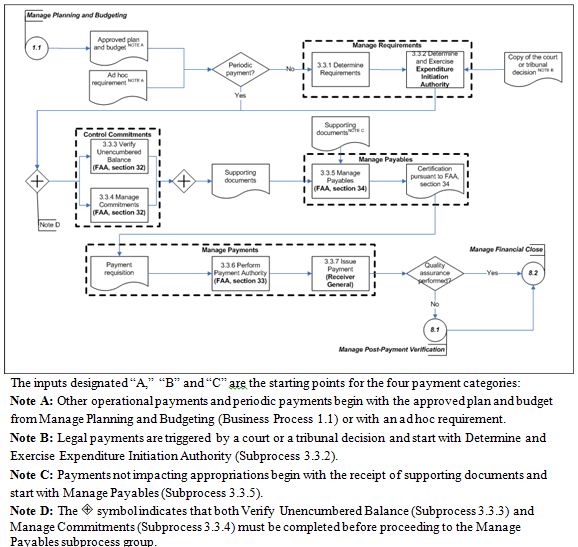

As illustrated in Figure 1, Manage Other Payments comprises seven subprocesses (3.3.1 to 3.3.7). These are arranged in four subprocess groups, as follows.

Manage Requirements is the start of the Manage Other Payments business process and involves the definition of requirements, prepared by an employee or the responsibility centre manager, and the determination and exercising of expenditure initiation authority. This subprocess group applies to other operational payments and legal payments.

Control Commitments involves verifying the availability of a sufficient unencumbered balance and creating and updating commitments according to department-specific policy or procedures. Responsibility centre managers are accountable for monitoring commitments against their budget. Control Commitments connects to two subprocesses groups: Manage Requirements, to create the commitment; and Manage Payables, to ensure that sufficient unencumbered funds are available before proceeding with the payment, and to close the commitment once the final request for payment has been issued. This subprocess group applies to other operational payments, legal payments and periodic payments.

Manage Payables involves handling invoices, claims, agreements, remittances or deduction requests; performing account verification; and providing certification authority pursuant to section 34 of the FAA. This subprocess group applies to all four categories of payments. Normally, the responsibility centre manager performs account verification and certification. However, for some non-pay employee-related payments, these activities may be performed by the compensation role and, for legal payments and payments not impacting appropriations, by financial services.

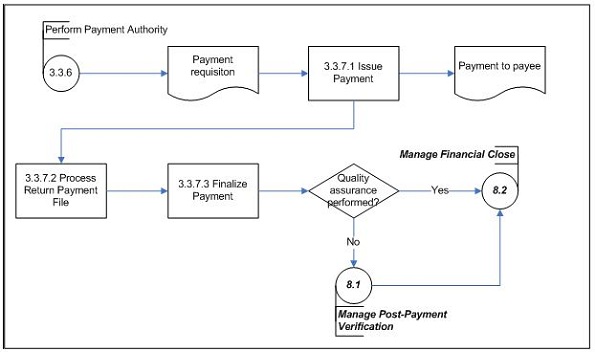

Manage Payments ends the Manage Other Payments business process and involves performing quality assurance activities when applicable, exercising payment authority pursuant to section 33 of the FAA, completing and submitting payment requisitions, and finalizing payments. When quality assurance is performed, the process flow continues to Manage Financial Close (Business Process 8.2). When quality assurance is not performed, the process flow continues to Manage Post-Payment Verification (Business Process 8.1). Financial services is responsible for managing payment requisitions, certifying payments pursuant to section 33 of the FAA, and recording payments. The Banking and Cash Management Sector of the Receiver General is responsible for issuing payments. This subprocess applies to all four categories of payments.

Because not all subprocesses apply to all categories of payments, the payment categories have different entry points to the Manage Other Payments business process, as illustrated in Figure 1. In addition, the order in which Determine and Exercise Expenditure Initiation Authority (Subprocess 3.3.1), Verify Unencumbered Balance (Subprocess 3.3.3) and Manage Commitments (Subprocess 3.3.4) are performed may differ from what is depicted in Figure 1, depending on department-specific policy or procedures.

Figure 1. Manage Other Payments – Level 2 Process Flow

Text version: Figure 1. Manage Other Payments – Level 2 Process Flow

Throughout the Manage Other Payments business process, the vendor master data file may need to be updated; the connection points to Manage Vendor Master Data File (Business Process 7.1) are provided in Manage Payables (Subprocess 3.3.5).

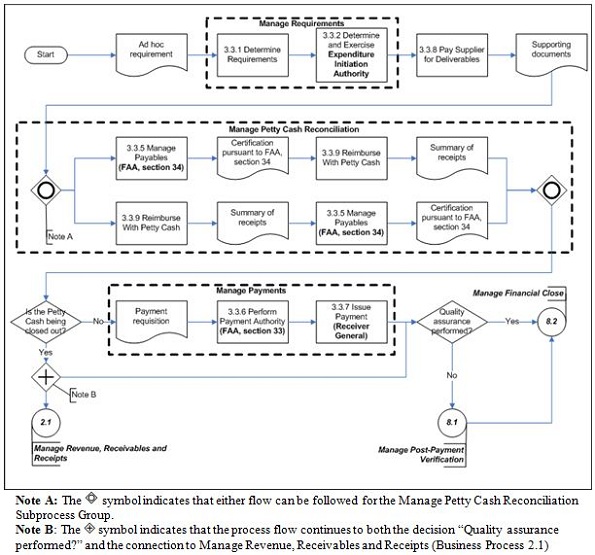

From time to time, operational expenses are paid with petty cash. The use of petty cash as a payment method and the reconciliation of petty cash are described in Appendix E.

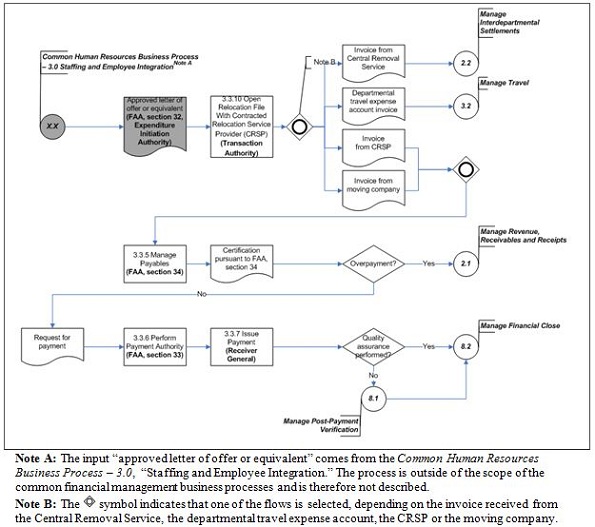

The Level 2 process flow for payments covering the relocation of employees is unique and is described in Appendix F.

1. Date of Issue

This guideline was issued on May 30, 2013.

2. Context

This guideline is part of a set of guidelines designed to assist departments See footnote [4] in implementing common financial management business processes. This guideline supports the Policy on the Stewardship of Financial Management Systems and the Directive on the Stewardship of Financial Management Systems.

This guideline presents the “should be” model for Manage Other Payments, describing roles, responsibilities and recommended activities from a financial management perspective. Most activities are financial in nature, but some non-financial activities are included in order to provide a comprehensive process description; these activities are identified as outside the scope of Manage Other Payments. The recommended activities comply with the Financial Administration Act, other legislation, and Government of Canada policy instruments.

Recognizing that deputy heads are ultimately responsible for all aspects of financial management systems within their department, standardizing and streamlining financial management system configurations, business processes and data across government provides significant direct and indirect benefits relative to the quality of financial management in the Government of Canada. By establishing a common set of rules, standardization reduces the multitude of different systems, business processes and data that undermine the quality and cost of decision-making information. As government-wide standardization increases, efficiency, integrity and interoperability are improved. See footnote [5]

3. Introduction

3.1 Scope

This guideline defines Manage Other Payments, which involves those common See footnote [6] payment transactions not covered by Manage Interdepartmental Settlements (Business Process 2.2), Manage Procure to Payment (Business Process 3.1), Manage Travel (Business Process 3.2), Pay Administration (Business Process 5.1), and Manage Grants and Contributions (Business Process 6.1).

The following categories of common payment transactions are covered in this guideline:

- Other operational payments result in charges against appropriations and include awards, honoraria, ex gratia payments, repayable loans, employee reimbursements, returns as described in section 20 of the Financial Administration Act (FAA), accountable advances (excluding travel advances, which are covered in Manage Travel (Business Process 3.2)), and imprest funds. These payments do not use a purchase order to initiate a transaction and do not follow a formal procurement process.

- Legal payments also result in charges against appropriations and include settlements, claims against the Crown, and nugatory payments. These transactions are triggered by a court or a tribunal decision rather than by a program requirement. Because these transactions do not involve the acquisition of goods or services, there is no procurement process. A legal opinion and documentation, such as the copy of the court or tribunal decision, are required before the payment can be made.

- Payments not impacting appropriations are made out of the Consolidated Revenue Fund and include garnishments, other deductions, remittances of taxes collected, payments against imprest funds, repayment of contractor holdbacks, and some types of payments against specified purpose accounts. See footnote [7] Although these transactions do not result in charges against appropriations and there is no acquisition of goods or services, FAA certification and payment authority are still required.

- Periodic payments are recurring (usually monthly) payments resulting from a multi-year agreement established under Manage Procure to Payment (Business Process 3.1), starting with the second and subsequent payments of the agreement. These payments can be a fixed amount (for example, leases and rent) or usage-based (for example, telecommunications, utilities and taxis) and result in a reduction in appropriations. There is no need to identify the requirements or to obtain expenditure initiation authority. Some organizations may conduct a reallocation exercise, to ensure that the costs are properly attributed to responsibility centres.

This guideline covers the following subprocess groups:

- Manage Requirements;

- Control Commitments;

- Manage Payables; and

- Manage Payments.

Some financial management activities described in this guideline are also related to internal controls. The intent is neither to provide a complete listing of controls, nor to produce a control framework; but the process description may provide useful content for the development of a department's control framework.

3.2 Structure of the Guideline

The remainder of this guideline is structured as follows: Section 4 provides an overview of the roles that carry out Manage Other Payments. Section 5 presents a detailed description of the Manage Other Payments business process, including subprocess groups, subprocesses, activities and responsible roles. Appendix A provides definitions of terminology used in the guideline, and relevant abbreviations are listed in Appendix B. Appendix C describes the methodology used in the guideline, and Appendix D elaborates on the roles and responsibilities outlined in Section 4. The process flow for the use and reconciliation of petty cash is described in Appendix E. Finally, the process flow for managing payments related to the relocation of employees is described in Appendix F.

3.3 References

The following references apply to this guideline.

3.3.1 Acts and Regulations

- Accountable Advances Regulations

- Federal Accountability Act

- Financial Administration Act

- Garnishment, Attachment and Pension Diversion Act

- Payments and Settlements Requisitioning Regulations, 1997

3.3.2 Policy Instruments

- Directive on Account Verification

- Directive on Accountable Advances

- Directive on Claims and Ex Gratia Payments

- Directive on Delegation of Financial Authorities for Disbursements

- Directive on Departmental Bank Accounts

- Directive on Executive Compensation

- Directive on Expenditure Initiation and Commitment Control

- Directive on Financial Management of Pay Administration

- Directive on Payment Requisitioning and Cheque Control

- Directive on Specified Purpose Accounts

- Directive on the Administration of Required Training

- Directive on the Management of Expenditures on Travel, Hospitality and Conferences

- Directive on the Stewardship of Financial Management Systems

- Foreign Service Directives

- Guideline on Accountable Advances

- Guideline on Claims and Ex Gratia Payments

- National Joint Council (NJC) Relocation Directive

- Policy on Financial Management Governance

- Policy on Internal Control

- Policy on Learning, Training and Development

- Policy on the Stewardship of Financial Management Systems

- Standards on Knowledge for Required Training

3.3.3 Other References

4. Roles and Responsibilities

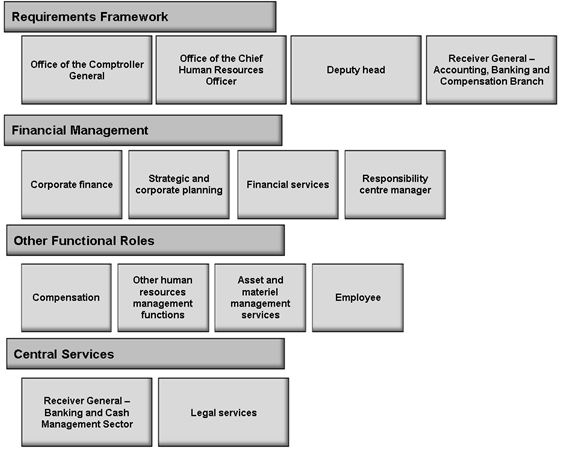

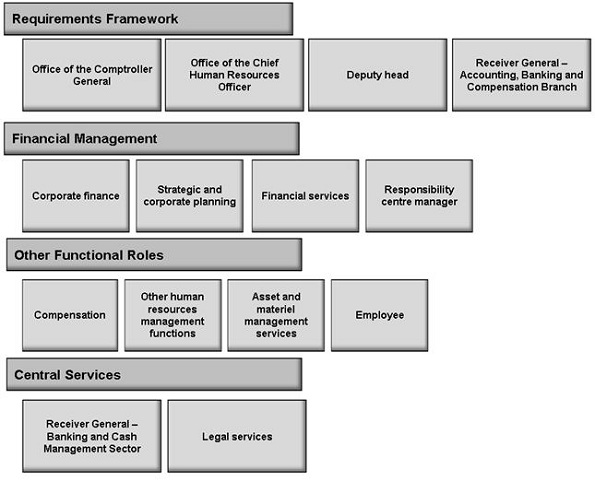

Figure 2 depicts the roles involved in the Manage Other Payments business process, grouped by stakeholder category.

Figure 2. Roles involved in Manage Other Payments

Text version: Figure 2. Roles involved in Manage Other Payments

In this guideline, a role is an individual or a group of individuals whose involvement in an activity is described using the Responsible, Accountable, Consulted and Informed (RACI) approach. Because of differences among departments, a role may not correspond to a specific position, title or organizational unit. The roles and responsibilities for Manage Other Payments are briefly described in Sections 4.1 to 4.4 and are explained in more detail in Appendix D.

4.1 Requirements Framework

The following organizational roles act in support of legislation, such as the Financial Administration Act (FAA) and the Federal Accountability Act, and define policy or processes that must be followed.

- The Office of the Comptroller General is the policy authority for financial management and for the management of assets and acquired services.

- The Office of the Chief Human Resources Officer is the policy authority for human resources management, but some functions are also performed by the Public Service Commission of Canada.

- The deputy head is responsible for providing leadership by demonstrating financial responsibility, transparency, accountability and ethical conduct in financial and resource management. This includes compliance with legislation, regulations, Treasury Board policies and financial authorities. See footnote [8]

- The Receiver General – Accounting, Banking and Compensation Branch issues directives and guidance to federal departments on government accounting, payment and deposit.

4.2 Financial Management

The following organizational roles act in response to financial management policy and process requirements—for example, from the Office of the Comptroller General and from deputy heads.

- The corporate finance role supports the deputy head and the chief financial officer in meeting their financial management accountabilities by developing, communicating and maintaining the departmental financial management framework and by providing leadership and oversight on the proper application and monitoring of financial management across the department. See footnote [9]

- The strategic and corporate planning role coordinates input into the department-specific strategic, integrated, and operational planning processes defined within the department and in support of central agency requirements.

- The financial services role carries out the day-to-day transactional financial management operations.

- The responsibility centre manager role is responsible and accountable for exercising the following delegated authorities:

- Initiating expenditures;

- Controlling commitments pursuant to section 32 of the FAA;

- Entering into contracts, which is known as transaction authority—this authority is outside the scope of Manage Other Payments and is covered in Manage Contracts (Subprocess 3.1.5) of Manage Procure to Payment (Business Process 3.1); and

- Performing account verification and certification pursuant to section 34 of the FAA.

4.3 Other Functional Roles

The following organizational roles act in response to policy and process requirements from the Office of the Chief Human Resources Officer, deputy heads, and the Office of the Comptroller General. These roles are not financial in nature but are included in order to provide a comprehensive description.

- The compensation role receives requests for pay transactions, confirms that the employee is eligible for the payment, performs any required calculations, and enters the transaction into the Regional Pay System (RPS). This role also performs part of the FAA section 34 certification of pay transactions and for remittance of other payroll deductions.

- The other human resources management functions role provides critical information (for example, classification decisions, identification of successful candidates in a staffing action, decisions on disciplinary actions, or identification of recipients and amounts for special awards) to responsibility centre managers, compensation and employees—information that can result in pay transactions. Note that this role does not administer pay transactions.

- The asset and materiel management services role carries out the day-to-day transactional operations for the management of assets and acquired services and for the procurement of goods and services.

- The employee role is performed by a federal government person, “who is any person currently paid a salary or remunerated from the Consolidated Revenue Fund.” See footnote [10] Employees can initiate or be the recipient of accountable advances and reimbursable expenses.

4.4 Central Services

The following organizational roles provide a central service to other government departments.

- The Receiver General – Banking and Cash Management Sector manages the treasury functions of the government, which includes issuing most payments on behalf of the government and controlling the government's bank accounts.

- The legal services role is provided by the Department of Justice Canada to federal departments. The Department of Justice Canada is responsible for providing legal opinions and advice, including negotiation advice, and conducting litigation by or against the Crown and against its servants. See footnote [11] Legal services are consulted about payments such as garnishments, ex gratia payments, and claims against the Crown.

5. Process Flows and Descriptions

Appendix C describes the methodology used in this section.

5.1 Overview of Manage Other Payments

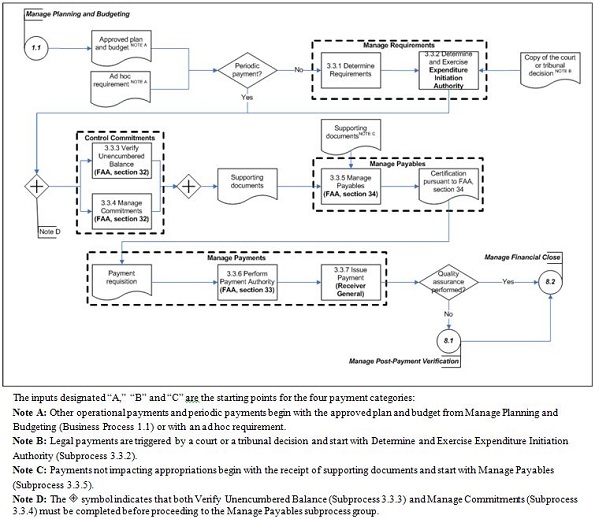

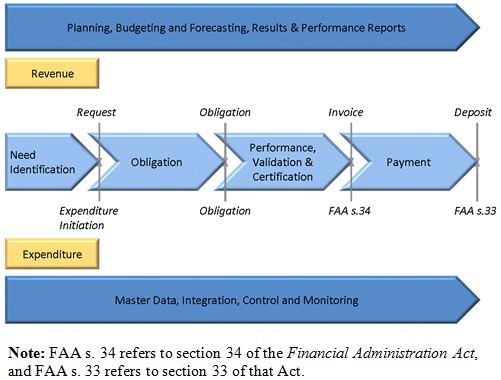

As illustrated in Figure 3, the Manage Other Payments business process comprises seven subprocesses (3.3.1 to 3.3.7). These are arranged in four subprocess groups:

- Manage Requirements;

- Control Commitments;

- Manage Payables; and

- Manage Payments.

Because not all subprocesses apply to all categories of payments, the payment categories have different entry points to the Manage Other Payments business process, as illustrated in Figure 3. In addition, the order in which Determine and Exercise Expenditure Initiation Authority (Subprocess 3.3.1), Verify Unencumbered Balance (Subprocess 3.3.3) and Manage Commitments (Subprocess 3.3.4) are performed may differ from what is depicted in Figure 3, depending on department-specific policy or procedures.

Figure 3. Manage Other Payments – Level 2 Process Flow

Text version: Figure 3. Manage Other Payments – Level 2 Process Flow

The subprocesses within each subprocess group and the roles and responsibilities relevant to each subprocess are summarized below.

Manage Requirements

- Determine Requirements (Subprocess 3.3.1): The responsibility centre manager or an employee identifies the requirements for an expenditure on the basis of the approved plan and budget or an ad hoc requirement, and prepares the justification. This subprocess applies to other operational payments.

- Determine and Exercise Expenditure Initiation Authority (Subprocess 3.3.2): The responsibility centre manager ensures that he or she has been delegated the appropriate expenditure initiation authority and exercises the authority or obtains approval. See footnote [12] This subprocess applies to other operational payments and legal payments.

Control Commitments

- Verify Unencumbered Balance (Subprocess 3.3.3): The responsibility centre manager verifies that a sufficient unencumbered balance is available before proceeding with the payment. This subprocess applies to other operational payments, legal payments and periodic payments.

- Manage Commitments (Subprocess 3.3.4): After the availability of a sufficient unencumbered balance is confirmed, a commitment is created. Commitments are recorded and updated according to department-specific policy or procedures. This subprocess applies to other operational payments, legal payments and periodic payments.

Manage Payables

- Manage Payables (Subprocess 3.3.5): Following receipt of the invoice, claim, agreement or remittance, account verification is performed pursuant to section 34 of the Financial Administration Act (FAA). Certification authority is exercised by the responsibility centre manager, See footnote [13] and a request for payment is prepared and sent to financial services. Account verification is performed by the responsibility centre manager, financial services or compensation, depending on the transaction. This subprocess applies to all four payment categories.

Manage Payments

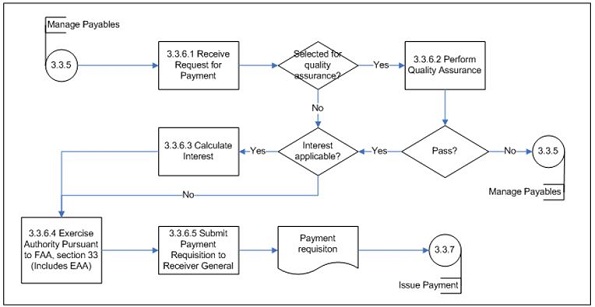

- Perform Payment Authority (Subprocess 3.3.6): Manage Payments starts with the receipt of a request for payment. During the payment process, quality assurance is performed by financial services as part of exercising payment authority pursuant to section 33 of the FAA. This subprocess applies to all four payment categories.

- Issue Payment (Subprocess 3.3.7): The payment requisition is sent to the Receiver General for payment issuance. The payment requisition files are edited and validated, and the payments are released by the Receiver General. The Receiver General produces a generic return file containing unique payment references for control purposes. The payment records are updated in the departmental financial and materiel management system See footnote [14] by financial services, and the Manage Other Payments business process ends. When quality assurance is performed, the process flow continues to Manage Financial Close (Business Process 8.2). When quality assurance is not performed, the process flow continues to Manage Post-Payment Verification (Business Process 8.1). This subprocess applies to all four payment categories.

Table 1 illustrates the relationship between the subprocesses and the four payment categories covered by this guideline.

| Subprocess | Other Operational Payments | Legal Payments | Payments Not Impacting Appropriations | Periodic Payments |

|---|---|---|---|---|

|

Note A: For periodic payments, Determine Requirements (Subprocess 3.3.1) and Determine and Exercise Expenditure Initiation Authority (Subprocess 3.3.2) occur as part of Manage Procure to Payment (Business Process 3.1). |

||||

| 3.3.1 Determine Requirements | Applies | Does not apply | Does not apply | Does not apply( See table 1 Note A) |

| 3.3.2 Determine and Exercise Expenditure Initiation Authority | Applies | Applies | Does not apply | Does not apply( See table 1 Note A) |

| 3.3.3 Verify Unencumbered Balance (FAA, section 32) |

Applies | Applies | Does not apply | Applies |

| 3.3.4 Manage Commitments (FAA, section 32) |

Applies | Applies | Does not apply | Applies |

| 3.3.5 Manage Payables (FAA, section 34) |

Applies | Applies | Applies | Applies |

| 3.3.6 Perform Payment Authority (FAA, section 33) |

Applies | Applies | Applies | Applies |

| 3.3.7 Issue Payment (Receiver General) |

Applies | Applies | Applies | Applies |

5.2 Manage Requirements Subprocess Group

Manage Requirements is the start of the Manage Other Payments business process for other operational payments and legal payments, beginning with the approved plan and budget from Manage Planning and Budgeting (Business Process 1.1), an ad hoc requirement, or a copy of the court or tribunal decision. This subprocess group involves the definition of requirements, prepared by an employee or the responsibility centre manager, and the determination and exercising of expenditure initiation authority.

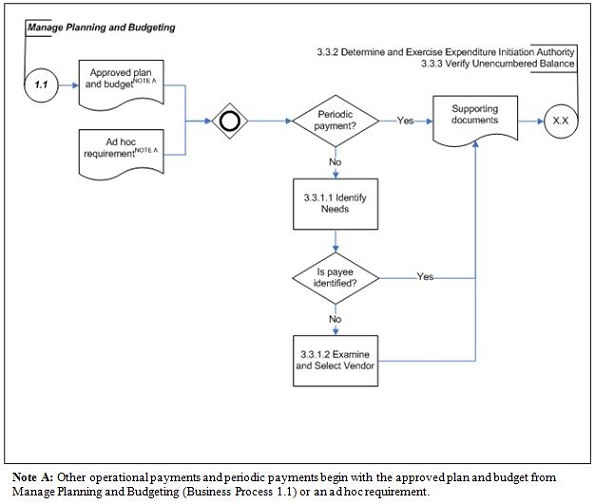

5.2.1 Determine Requirements (Subprocess 3.3.1)

As illustrated in Table 2, this subprocess applies to other operational payments.

| Subprocess | Other Operational Payments | Legal Payments | Payments Not Impacting Appropriations | Periodic Payments See footnote [15] |

|---|---|---|---|---|

| Determine Requirements | Applies | Does not apply | Does not apply | Does not apply |

Based on the approved plan and budget or an ad hoc requirement, the justification for the other operational payment is prepared by the responsibility centre manager or an employee. Figure 4 depicts the Level 3 subprocess flow for Determine Requirements.

Figure 4. Determine Requirements (Subprocess 3.3.1) – Level 3 Process Flow

Text version: Figure 4. Determine Requirements (Subprocess 3.3.1) – Level 3 Process Flow

5.2.1.1 Activities

Consistent with the approved plan and budget from Manage Planning and Budgeting (Business Process 1.1) or an ad hoc requirement, the responsibility centre manager or an employee identifies a need and prepares the justification (Activity 3.3.1.1 – Identify Needs). Other operational payments may be launched by a responsibility centre manager to disburse a monetary employee recognition award or a repayable loan established under an agreement. Alternatively, employees may submit a request to obtain an accountable advance or a reimbursement for expenses incurred—for example, for a professional development activity or for parking. Travel advances are outside the scope of this business process and are covered in Manage Travel (Business Process 3.2).

For some transactions, a consultation and a justification may be required when selecting a vendor (Activity 3.3.1.2 – Examine and Select Vendor)—for example, for employee reimbursements when the payee is the employee and the vendor is the third party selected by the employee. Although the payment is a reimbursement to an employee rather than to an external vendor, compliance with Treasury Board and departmental policies is still required.

The content of the justification varies with the type of transaction. The following are examples of the types of documentation required.

- Accountable Advances: Employees submit a request conforming to the Directive on Accountable Advances See footnote [16] and other relevant policy instruments.

- Awards: A monetary award is supported by an awards plan and by a consultation with the other human resources management functions role, ensuring that the recognition is valid and appropriate.

- Reimbursements: For a reimbursement request related to training, learning or development, the supporting documentation should include an approved Personal Learning Plan. When the reimbursement is for hospitality, the request should be aligned with the annual budget and conform to the Directive on the Management of Expenditures on Travel, Hospitality and Conferences.

- Repayable Loans: The posting assignment notice supports the request for a posting loan under FSD-10 of the Foreign Service Directives. Other repayable loans, excluding repayable contributions, are triggered by a loan application received and approved by the program area. (Repayable contributions are covered in Manage Grants and Contributions (Business Process 6.1)). The approval of the loan occurs in the appropriate program area, whereas this business process focuses on the loan disbursement. The collection of the loan is covered in Manage Revenues, Receivables and Receipts (Business Process 2.1).

5.2.1.2 Roles and Responsibilities

There are two potential scenarios for the activities of this subprocess. In the first scenario (S1), the employee initiates the transaction, as is the case with accountable advances and reimbursable expenses. In the second scenario (S2), the responsibility centre manager initiates the transaction. In both scenarios, the role initiating the transaction is responsible and accountable.

Table 3 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

|

Legend

|

||||||

| 3.3.1.1 Identify Needs |

|

S1: EE S2: RCM |

S1: EE S2: RCM |

S1: CF, HR, RCM, SCP S2: CF, EE, HR, SCP |

S1: RCM S2: N/A |

S1: DFMS S2: DFMS |

| 3.3.1.2 Examine and Select Vendor |

|

S1: EE S2: RCM |

S1: EE S2: RCM |

S1: CF, HR, RCM S2: CF |

S1: RCM S2: N/A |

S1: DFMS S2: DFMS |

5.2.2 Determine and Exercise Expenditure Initiation Authority (Subprocess 3.3.2)

As illustrated in Table 4, this subprocess applies to other operational payments and legal payments.

| Subprocess | Other Operational Payments | Legal Payments | Payments Not Impacting Appropriations | Periodic Payments |

|---|---|---|---|---|

| Determine and Exercise Expenditure Initiation Authority | Applies | Applies | Does not apply | Does not apply |

Responsibility centre managers ensure that they have been delegated the appropriate expenditure initiation authority and exercise or obtain that authority. See footnote [17]

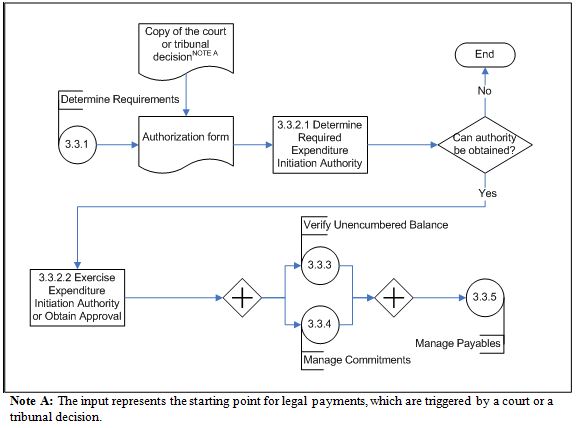

For other operational payments, this subprocess continues from Determine Requirements (Subprocess 3.3.1). For legal payments, this subprocess represents the start of the Manage Other Payments business process and is launched when the department receives a copy of the court or tribunal decision. Figure 5 depicts the Level 3 process flow for Determine and Exercise Expenditure Initiation Authority.

Figure 5. Determine and Exercise Expenditure Initiation Authority (Subprocess 3.3.2) – Level 3 Process Flow

The level of expenditure initiation authority is based on the department's delegation of authorities, according to the delegation documents approved by the minister and the deputy head, See footnote [18] where expenditure initiation authority is defined as “the authority to incur an expenditure or to make an obligation to obtain goods or services that will result in the eventual expenditure of funds. This would include the decision…to order supplies or services.” See footnote [19] The creation and maintenance of the delegation of authority instruments is outside the scope of Manage Other Payments and is addressed in Manage Delegation of Financial and Spending Authorities (Business Process 7.4). Expenditure initiation authority is distinct from commitment authority, which “is the authority to carry out one or more specific functions related to the control of financial commitments.” See footnote [20] These authorities, together with transaction authority, make up spending authority. Transaction authority is outside the scope of this business process and is covered in Manage Contracts (Subprocess 3.1.5) of Manage Procure to Payment (Business Process 3.1).

5.2.2.1 Activities

The responsibility centre manager determines the appropriate expenditure initiation authority by consulting the delegation documents and Treasury Board policies (Activity 3.3.2.1 – Determine Required Expenditure Initiation Authority). When the responsibility centre manager does not possess the required expenditure initiation authority (for example, for ex gratia payments or settlements) or when the responsibility centre manager directly or indirectly benefits from the expenditure, See footnote [21] he or she should obtain the signatures of those with delegated expenditure initiation authority (Activity 3.3.2.2 – Exercise Expenditure Initiation Authority or Obtain Approval). Supporting documents, such as an agreement, an awards plan or a personal learning plan, are provided to the delegated authority.

In some situations, the authority to initiate other operational payments may not be obtained, in which case the requirements may be amended or the expenditure initiation process ends. However, departments must usually comply with a court or a tribunal decision, and therefore, expenditure initiation authority for legal payments must be obtained.

At the same time that expenditure initiation authority is being exercised, the availability of a sufficient unencumbered balance is determined See footnote [22] during Verify Unencumbered Balance (Subprocess 3.3.3). If an unencumbered balance is available, a commitment conforming to department-specific policy or procedures is created during Manage Commitments (Subprocess 3.3.4).

The Manage Requirements subprocess group ends when:

- The requirement is defined or the notice to disburse funds for legal payments is received and approved by the appropriate expenditure initiation authority;

- The unencumbered balance is confirmed during Verify Unencumbered Balance (Subprocess 3.3.3); and

- The commitment is recorded during Manage Commitments (Subprocess 3.3.4). See footnote [23]

The justification for expenditure initiation approval will vary with the type of transaction. The following are examples of the types of documentation required.

Other Operational Payments

- Accountable advances: Employees must complete a personal responsibility document, acknowledging responsibility for the advance. See footnote [24]

- Ex gratia payments: A legal opinion is required when signing off ex gratia payments See footnote [25] Ex gratia payments are approved by the appropriate delegated authority. See footnote [26]

- Repayable loans: Repayable loans are initiated in the program area where the loan agreement is completed. Approval in the form of a signed agreement is provided by the program manager with delegated authority.

Legal Payments

- Settlements: The documentation could include a settlement or an agreement duly signed by the delegated authority, or a copy of the court or tribunal decision. A legal opinion may be required. The Directive on Claims and Ex Gratia Payments provides guidance on thresholds and requirements—for example, claims over $25,000 require a legal opinion. See footnote [27] Because of the sensitive nature of settlements, the associated data should be kept confidential.

5.2.2.2 Roles and Responsibilities

There are two potential scenarios for Activity 3.3.2.1 – Determine Required Expenditure Initiation Authority. In the first scenario (S1), the employee initiates the transaction, as is the case with reimbursements. In the second scenario (S2), the responsibility centre manager initiates the transaction. In both scenarios, the role initiating the transaction is responsible and accountable.

For Activity 3.3.2.2 – Exercise Expenditure Initiation Authority or Obtain Approval, the responsibility centre manager is accountable for obtaining expenditure initiation authorization.

Table 5 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

|

Legend

|

||||||

| 3.3.2.1 Determine Required Expenditure Initiation Authority |

|

S1: EE S2: RCM |

S1: EE S2: RCM |

S1: CF, RCM S2: CF |

S1: RCM S2: N/A |

S1: DFMS S2: DFMS |

| 3.3.2.2 Exercise Expenditure Initiation Authority or Obtain Approval |

|

RCM | RCM | CF | EE | DFMS |

5.3 Control Commitments Subprocess Group

The Control Commitments subprocess group involves verifying the availability of a sufficient unencumbered balance and creating and updating commitments according to department-specific policy or procedures. Control Commitments connects to two subprocess groups: Manage Requirements, to create the commitment; and Manage Payables, to ensure that sufficient unencumbered funds are available to proceed with the payment and to close the commitment once the request for payment has been issued.

5.3.1 Verify Unencumbered Balance (Subprocess 3.3.3)

As illustrated in Table 6, this subprocess applies to other operational payments, legal payments and periodic payments.

| Subprocess | Other Operational Payments | Legal Payments | Payments Not Impacting Appropriations | Periodic Payments |

|---|---|---|---|---|

| Verify Unencumbered Balance | Applies | Applies | Does not apply | Applies |

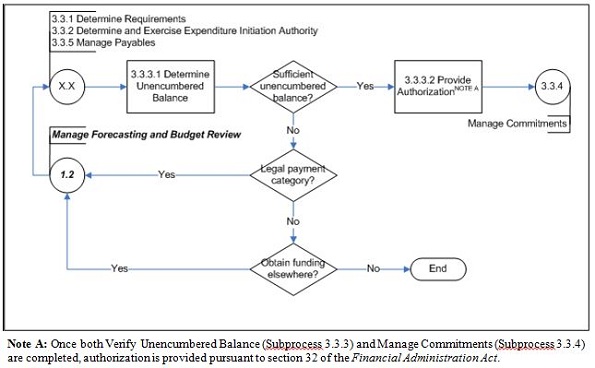

The responsibility centre manager ensures that a sufficient unencumbered balance is available before proceeding with the payment . See footnote [28] Figure 6 depicts the Level 3 process flow for Verify Unencumbered Balance.

Figure 6. Verify Unencumbered Balance (Subprocess 3.3.3) – Level 3 Process Flow

Text version: Figure 6. Verify Unencumbered Balance (Subprocess 3.3.3) – Level 3 Process Flow

The deputy head or other person charged with the administration of a program is responsible for establishing procedures to ensure that commitments are controlled and accounted for and that records pertaining to commitments are maintained. See footnote [29] In addition, departments should have processes in place to verify the availability of unencumbered balances at the time of expenditure initiation and prior to entering into a contract. See footnote [30] Commitment authority is delegated in writing to departmental officials by the deputy head. See footnote [31] The delegated official is responsible for ensuring that a sufficient unencumbered balance is available before entering into a contract or other arrangement. See footnote [32] The creation and the maintenance of the delegation documents are addressed in Manage Delegation of Financial and Spending Authorities (Business Process 7.4). Commitment control, which includes accounting for those commitments, is an ongoing activity throughout the Manage Other Payments business process.

5.3.1.1 Activities

Before proceeding with the payment, the responsibility centre manager initiating the expenditure ensures that a sufficient unencumbered balance is available by reviewing budget information, including a detailed analysis of outstanding or the previous year's commitments as well as unpaid invoices (Activity 3.3.3.1 – Determine Unencumbered Balance). Ongoing payments, such as periodic payments, require that continuing commitments are kept separate for the current fiscal year and for each future year within the most recently approved budget. See footnote [33] The unencumbered balance is reviewed when account verification is performed or when the commitment requires an update (Manage Payables (Subprocess 3.3.5)).

When a sufficient unencumbered balance is available, department-specific functions related to commitment authority are carried out (Activity 3.3.3.2 – Provide Authorization). It is essential to ensure that appropriate evidence exists to substantiate the authorization pursuant to section 32 of the Financial Administration Act, as stipulated by department-specific policy and procedures. See footnote [34]

When the unencumbered balance is insufficient, budgets are reviewed to identify alternative funding See footnote [35] or the Manage Other Payments business process ends. For legal payments, a budget reallocation is required, as described in Manage Forecasting and Budget Review (Business Process 1.2).

Further details about this subprocess are provided below for the payment categories to which it applies.

Other Operational Payments

- There are no additional details.

Legal Payments

- Given the obligatory nature of the disbursement, funds will need to be reallocated if they are not readily available.

Periodic Payments

- Anticipated periodic payments must be reflected in the approved plan and budget.

- Annually, the responsibility centre manager ensures that there are sufficient funds for upcoming periodic payments.

- It may be difficult to determine the amount of usage-based invoices because of their ad hoc nature. Typically, the amount is based on estimated expenditures, and the commitment is adjusted as needed once the invoices are processed, during Manage Payables (Subprocess 3.3.5).

5.3.1.2 Roles and Responsibilities

The responsibility centre manager is accountable for his or her commitments.

Table 7 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

|

Legend

Note A: The individual exercising the delegated commitment authority may not be the same individual initiating the expenditure; the latter is therefore informed of the authorization decision. |

||||||

| 3.3.3.1 Determine Unencumbered Balance |

|

RCM | RCM | FIN | FIN | DFMS |

| 3.3.3.2 Provide Authorization |

|

RCM | RCM | CF | EE, RCM( See table 7 Note A) | DFMS |

5.3.2 Manage Commitments (Subprocess 3.3.4)

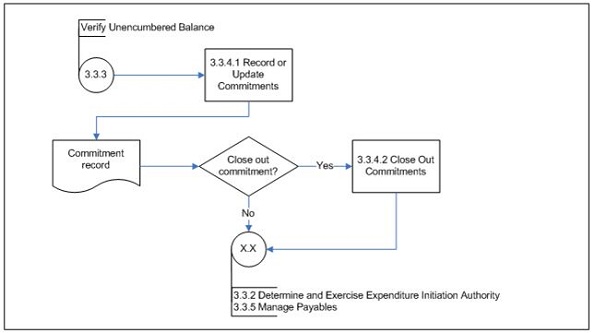

While the unencumbered balance is being confirmed, the responsibility centre manager or financial services records or updates commitments according to department-specific policy or procedures. Once the unencumbered balance and the appropriate commitment control have been confirmed, section 32 of the Financial Administration Act has been exercised. Figure 7 depicts the Level 3 process flow for Manage Commitments.

Figure 7. Manage Commitments (Subprocess 3.3.4) – Level 3 Process Flow

Text version: Figure 7. Manage Commitments (Subprocess 3.3.4) – Level 3 Process Flow

5.3.2.1 Activities

As illustrated in Table 8, this subprocess applies to other operational payments, legal payments and periodic payments.

| Subprocess | Other Operational Payments | Legal Payments | Payments Not Impacting Appropriations | Periodic Payments |

|---|---|---|---|---|

| Manage Commitments | Applies | Applies | Does not apply | Applies |

The responsibility centre manager is accountable for ensuring that the commitment, including a continuing commitment that affects future fiscal years, is recorded according to department-specific policy or procedures. The commitment is recorded or updated by asset and materiel management services, financial services or the responsibility centre manager. Throughout the Manage Other Payments business process, the commitment is monitored and updated as needed—for example, when the estimated use or value changes (Activity 3.3.4.1 – Record or Update Commitments).

Following receipt of the final invoice, the commitment is updated and closed out (Activity 3.3.4.2 – Close Out Commitments). The end objective of Determine and Exercise Expenditure Initiation Authority (Subprocess 3.3.2) and the Control Commitments subprocess group is to ensure that all commitments are managed and that responsibility centre managers do not exceed their allocated budgets or appropriations. See footnote [36]

It may be impractical to record individual commitments for payments of low-dollar value. Departments can implement alternative means of accounting for these commitments, provided that their department-specific policy or procedures indicate when it is appropriate to do so and how these commitments are to be accounted for. See footnote [37] Commitments are recorded according to the department's approved budget and serve to quantify the financial implications of the planned requirements.

Further details about this subprocess are provided below for the payment categories to which it applies.

Other Operational Payments

- Commitments are recorded according to department-specific policies or procedures.

Legal Payments

- Commitments are recorded according to department-specific policies or procedures.

Periodic Payments

- For ongoing, multi-year agreements covering rent, utilities or telecommunications, commitments must be recorded annually. See footnote [38] Department-specific policies or procedures could identify financial services or asset and materiel management services as roles supporting the responsibility centre manager in updating the commitments.

- Commitments are updated throughout the year.

- When monitoring or updating an agreement, Manage Contracts (Subprocess 3.1.5) and Administer Contracts and Deliverables (Subprocess 3.1.6) of Manage Procure to Payment (Business Process 3.1) are launched.

- The department may choose to allocate centralized costs to different responsibility centres or sub-activities for usage-based invoices, either when the commitment is created or when the invoice is received during Manage Payables (Subprocess 3.3.5), according to department-specific policy or procedures.

5.3.2.2 Roles and Responsibilities

The responsibility centre manager is accountable for his or her commitments.

Table 9 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

|

Legend

|

||||||

| 3.3.4.1 Record or Update Commitments |

|

AMS, FIN, RCM | RCM | FIN | N/A | DFMS |

| 3.3.4.2 Close Out Commitments |

|

AMS, FIN, RCM | RCM | FIN | RCM | DFMS |

5.4 Manage Payables Subprocess Group

This subprocess group involves handling invoices, claims, agreements, remittances or deduction requests; completing the account verification; and providing certification authority pursuant to section 34 of the Financial Administration Act (FAA). This subprocess group is the starting point for payments not impacting appropriations, which are paid out of the Consolidated Revenue Fund (CRF). Typically the responsibility centre manager performs account verification and provides certification pursuant to section 34 of the FAA. However, for some non-pay employee-related payments, these activities may also be performed by the compensation role or, for legal payments and payments not impacting appropriations, by financial services.

5.4.1 Manage Payables (Subprocess 3.3.5)

As illustrated in Table 10, this subprocess applies to all payment categories.

| Subprocess | Other Operational Payments | Legal Payments | Payments Not Impacting Appropriations | Periodic Payments |

|---|---|---|---|---|

| Manage Payables | Applies | Applies | Applies | Applies |

Upon receipt of invoices, claims, agreements, remittances or deduction requests and the required supporting documents, the following takes place:

- Account verification is performed;

- Certification authority pursuant to section 34 of the FAA is exercised by the responsibility centre manager; and

- A request for payment or settlement is prepared and sent to financial services.

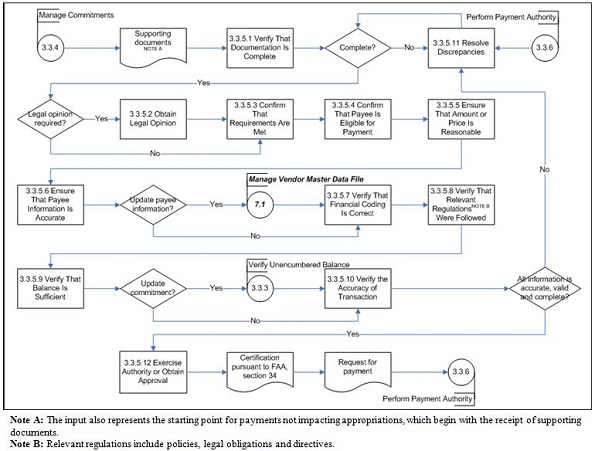

Figure 8 depicts the Level 3 process flow for Manage Payables.

Figure 8. Manage Payables (Subprocess 3.3.5) – Level 3 Process Flow

Text version: Figure 8. Manage Payables (Subprocess 3.3.5) – Level 3 Process Flow

Manage Payables (Subprocess 3.3.5) involves receiving, verifying and validating invoices, claims, agreements, remittances or deduction requests and other supporting documents. The agreements and any documents supporting the receipt of goods or the provision of services form part of the account verification process.

Manage Payables begins when the invoices, claims, agreements, remittances or deduction requests are received by the program area or by financial services. At this time, the date of receipt is recorded; the date of receipt is a key element in calculating interest, which is further described in Perform Payment Authority (Subprocess 3.3.6).

Account verification provides the necessary evidence to demonstrate that:

- The work has been performed;

- The goods have been supplied or the services have been rendered;

- The relevant agreement terms and conditions have been met;

- The transaction is accurate; and

- All authorities have been complied with. See footnote [39]

Primary responsibility for verifying individual accounts rests with the responsibility centre manager, who has the authority to confirm and certify entitlement pursuant to section 34 of the FAA. See footnote [40] All payments and settlements must be certified pursuant to section 34 of the FAA. Note that all payments made out of the CRF are governed by section 26 of the FAA, which states that “no payments shall be made out of the Consolidated Revenue Fund without the authority of Parliament.” See footnote [41]

To ensure adequate separation of duties, the following functions are kept separate when responsibility is assigned to individuals involved in the expenditures process: See footnote [42]

- Authority to enter into a contract (transaction authority): This activity is outside the scope of the Manage Other Payments business process and is performed during Manage Contracts (Subprocess 3.1.5) of Manage Procure to Payment (Business Process 3.1);

- Certification of the receipt of goods and the provision of services pursuant to section 34 of the FAA (certification authority): These activities are outside the scope of the Manage Other payments business process and are performed during Administer Contracts and Deliverables (Subprocess 3.1.6) of Manage Procure to Payment (Business Process 3.1);

- Determination of entitlement, verification of accounts, and preparation of requisitions for payment or settlement, pursuant to section 34 of the FAA (certification authority): These activities are performed during Manage Payables (Subprocess 3.3.5); and

- Certification of requisition for payment or settlement, pursuant to section 33 of the FAA (payment authority): This activity is conducted during Perform Payment Authority (Subprocess 3.3.6).

If the process or other circumstances do not allow such separation of duties, alternative control measures are implemented and documented.

Furthermore, Section 6.2.2 of the Directive on Delegation of Financial Authorities for Disbursements requires that persons with delegated authority do not exercise:

- Certification authority and payment authority on the same payment; and

- Spending, certification or payment authority for an expenditure from which they can directly or indirectly benefit—for example, when the payee is the individual with financial signing authority or when the expenditure is incurred for the benefit of that individual. See footnote [43]

Although account verification is normally performed prior to payment, completing account verification following payment is permitted in certain situations, such as acquisition card purchases, provided that the claim for payment is reasonable and meets the criteria outlined in the Directive on Account Verification. See footnote [44]

5.4.1.1 Activities

The Manage Payables subprocess involves the following activities See footnote [45] that support verification and certification pursuant to section 34 of the FAA:

- Verifying that the following are complete:

- The supporting documents provide an audit trail and demonstrate the agreed price and other specifications, the receipt of goods or the provision of services, and authorization according to the delegation of signing authorities; and

- The original document (for example, claim, legal document, invoice or advance payment form) requesting that a payment be made is complete (Activity 3.3.5.1 – Verify That Documentation Is Complete);

- Confirming that:

- The terms and conditions of the contract or agreement have been met, including price, quantity and quality;

- Work has been performed;

- Goods have been supplied, services have been rendered, or evidence that a liability exists has been provided; and

- The price is reasonable when, because of exceptional circumstances, the price is not specified in the contract or the agreement (Activity 3.3.5.3 – Confirm That Requirements Are Met);

- Confirming that the payee is entitled to, or eligible for, the payment. This confirmation includes verifying that the payee is appropriate, particularly for an assignment of the supplier's debt or for an alternate payee (Activity 3.3.5.4 – Confirm That Payee Is Eligible for Payment);

- Ensuring the reasonableness of the amount or price by validating with supporting documents. This validation may include a three-way match (Activity 3.3.5.5 – Ensure That Amount or Price Is Reasonable);

- Ensuring that the payee information is accurate and valid (Activity 3.3.5.6 – Ensure That Payee Information Is Accurate). The payee information should also be verified against the vendor master data file. If the payee information is not accurate and changes are required, Manage Vendor Master Data File (Business Process 7.1) explains how to make changes to the vendor master data file;

- Verifying that the financial coding is accurate and complete (Activity 3.3.5.7 – Verify That Financial Coding Is Correct);

- Verifying that all relevant statutes, regulations, Orders in Council, policies and directives, and other legal obligations have been complied with (Activity 3.3.5.8 – Verify That Relevant Regulations Were Followed). In addition to the policies identified in Section 3.3, “References,” there may be other policy instruments specific to the transaction that should be consulted; and

- Verifying that the transaction is accurate, including that the payment is not a duplicate; that discounts, credits or contract holdbacks have been deducted; that charges not payable have been removed; and that the invoice or the claim total has been calculated correctly(Activity 3.3.5.10 – Verify the Accuracy of Transaction).

The following activities also occur when certifying certain types of other payments:

- Obtaining a legal opinion or ensuring that it has been obtained, when required for settlements, ex gratia payments, and certain types of garnishments or claims against the Crown (Activity 3.3.5.2 – Obtain Legal Opinion). The Department of Justice Canada is responsible for the administration of garnishment summonses for family support and other obligations debts against public servants' salaries, in accordance with the Garnishment, Attachment and Pension Diversion Act. Summonses are served directly to the Department of Justice Canada, which validates and forwards these documents to departments for immediate action; See footnote [46]

- Ensuring that the commitment balance is sufficient to proceed with the payment for other operational, legal and periodic payments (Activity 3.3.5.9 – Verify That Balance is Sufficient). If the commitment balance is insufficient, the process flow returns to the Control Commitments subprocess group, to determine whether sufficient unencumbered funds are available (Verify Unencumbered Balance (Subprocess 3.3.3)) and to update the commitment as needed (Manage Commitments (Subprocess 3.3.4));

- Ensuring that the liability account balance is sufficient before proceeding with payments not impacting appropriations. If the balance is insufficient, then either the account balance or the payment amount is corrected;

- Ensuring that the responsibility centre manager follows the departmental procedures for determining and validating whether a payment to an employee is taxable for the purposes of the T4 Statement of Remuneration Paid; the T4A Statement of Pension, Retirement, Annuity, and Other Income; or equivalent, as well as notifying the compensation role of the determination, as required; and

- Ensuring that the responsibility centre manager follows the departmental procedures for other tax slips specific to periodic and other operational payments—for example, the T1204 Government Service Contract Payments form or equivalent.

Departments must ensure that suppliers are paid by the due date. Departments that fail to pay by the due date See footnote [47] must pay interest, without demand from the supplier, in accordance with the payment terms specified in the agreement. The Directive on Payment Requisitioning and Cheque Control does not allow a department to elect a minimum threshold for payment of interest. Certain payments, such as periodic payments, are paid according to a fee schedule or according to the terms of an agreement. See footnote [48] In addition, payments to employees are to be paid as soon as possible. See footnote [49] Information on determining the due date is available in the “Payment on Due Date” section of the Directive on Payment Requisitioning and Cheque Control.

The account verification activity performed for periodic payments (for example, rental agreements for shared equipment or taxi invoices) may include a reallocation exercise to attribute the costs to responsibility centres. The reallocation exercise should be based on an appropriate allocation strategy, using actual cost, average cost, or prorated costs by percentage. In these cases, the account verification process may be performed centrally or may be decentralized, and certification pursuant to section 34 of the FAA may be obtained through the participation of various individuals in different responsibility centres, or of different levels in the organizational hierarchy.

If, at any time during the account verification process, a discrepancy is identified or if the information is incomplete, the responsibility centre manager resolves the discrepancy by tracing the issue to its source (Activity 3.3.5.11 – Resolve Discrepancies). Once the issue is resolved, the account verification resumes or starts over.

Once the supporting documents have been verified and any discrepancies have been resolved, the account verification is complete and certification authority is exercised pursuant to section 34 of the FAA (Activity 3.3.5.12 – Exercise Authority or Obtain Approval). Certification is usually provided through a signature block on the documentation or a completed account verification checklist. The final output of the Manage Payables subprocess is an approved request for payment.

Account verification pursuant to section 34 of the FAA ensures that there is auditable evidence of verification—that is, the individuals who performed the account verification are identified and there is an audit trail.

The following are examples of the types of documentation required for the four payment categories when verifying or exercising certification authority:

Other operational payments

- Accountable advances: An approved request for an accountable advance.

- Awards: The awards plan and the justification for recognition.

- Ex gratia payments: An agreement and a legal opinion.

- Honoraria: The approved agreement.

- Reimbursements: The claim for a reimbursement, including evidence of research and the justification for the selected vendor as well as evidence of the receipt of deliverables, if applicable.

- Repayable loans: The approved loan agreement.

Legal payments

- Grievances and recourse: A claim.

- Other settlements: A copy of the court or tribunal decision for legal payments and other obligations resulting from a legal decision.

Payments not impacting appropriations

- A remittance, for provincial sales taxes; a deduction request, for voluntary payments; or a garnishee summons. For holdbacks, the responsibility centre manager certifies that the conditions for releasing holdbacks have been met. Information on deduction payments, specifically garnishments, often includes sensitive data that should kept confidential.

Periodic Payments

- Invoices from vendors—for example utility, telecommunication and taxi companies. When the payment is a fixed amount (for example, rent or a lease—a payment schedule outlining the payments for the year should be available; and

- Documentation supporting the receipt of goods or services—for example, signed taxi chit carbons or logs tracking usage.

5.4.1.2 Roles and Responsibilities

There are three scenarios depending on the roles responsible and accountable for the completion of the account verification and the certification of documents, pursuant to section 34 of the FAA:

- In the first scenario (S1), compensation performs account verification for non-pay employee payments, such as garnishments or other deductions.

- In the second scenario (S2), financial services performs account verification for legal payments and payments not impacting appropriations, such as remittances of taxes collected.

- In the third scenario (S3), the responsibility centre manager performs account verification.

Table 11 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

|

Legend

Return to Table 11 Note A: The authoritative source for most policy instruments is outside the DFMS. |

||||||

| 3.3.5.1 Verify That Documentation Is Complete |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, HR, RCM S2: CF, HR, RCM S3: CF, EE, FIN, HR |

S1: FIN, RCM S2. RCM S3: FIN |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.2 Obtain Legal Opinion |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, LS, RCM S2: CF, LS, RCM S3: CF, FIN, LS |

S1: N/A S2: N/A S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.3 Confirm That Requirements Are Met |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, HR, RCM S2: CF, HR, RCM S3: CF, HR, FIN |

S1: RCM S2: RCM S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.4 Confirm That Payee Is Eligible for Payment |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, HR, RCM S2: CF, HR, RCM S3: CF, FIN, HR |

S1: RCM S2: RCM S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.5 Ensure That Amount or Price Is Reasonable |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, HR, RCM S2: CF, HR, RCM S3: CF, HR, FIN |

S1: RCM S2: RCM S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.6 Ensure That Payee Information Is Accurate |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, RCM S2: CF, RCM S3: CF, FIN |

S1: RCM S2: RCM S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.7 Verify That Financial Coding Is Correct |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, RCM S2: CF, RCM S3: CF, FIN |

S1: RCM S2: RCM S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.8 Verify That Relevant Regulations Were Followed |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, HR, RCM S2: CF, HR, RCM S3: CF, FIN, HR |

S1: RCM S2: RCM S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.9 Verify That Balance Is Sufficient |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, RCM S2: CF, RCM S3: CF, FIN |

S1: RCM S2: RCM S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.10 Verify the Accuracy of Transaction |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, RCM S2: CF, RCM S3: CF, FIN |

S1: RCM S2: RCM S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.11 Resolve Discrepancies |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, EE, FIN, HR S2: CF, EE, HR S3: CF, EE, FIN, HR |

S1: FIN S2: N/A S3: FIN |

S1: DFMS S2: DFMS S3: DFMS |

| 3.3.5.12 Exercise Authority or Obtain Approval |

|

S1: COMP S2: FIN S3: RCM |

S1: COMP S2: FIN S3: RCM |

S1: CF, FIN, RCM S2: CF, RCM S3: CF, FIN |

S1: RCM S2: RCM S3: N/A |

S1: DFMS S2: DFMS S3: DFMS |

5.5 Manage Payments Subprocess Group

The Manage Payments subprocess group completes the Manage Other Payments business process and involves performing quality assurance activities when applicable, exercising payment authorization pursuant to section 33 of the Financial Administration Act (FAA), completing and submitting payment requisitions, and finalizing payments.

In some cases, reimbursements can be disbursed through petty cash; this is further described in Appendix E. In other cases, an acquisition card may be used; acquisition card statements are processed as part of the alternate process flow for acquisition cards, as described in Appendix E of Manage Procure to Payment (Business Process 3.1).

5.5.1 Perform Payment Authority (Subprocess 3.3.6)

As illustrated in Table 12, this subprocess applies to all payment categories.

| Subprocess | Other Operational Payments | Legal Payments | Payments Not Impacting Appropriations | Periodic Payments |

|---|---|---|---|---|

| Perform Payment Authority | Applies | Applies | Applies | Applies |

Perform Payment Authority starts with the receipt of a request for payment. Quality assurance is performed by financial services as part of payment authorization pursuant to section 33 of the FAA. Figure 9 depicts the Level 3 process flow for Perform Payment Authority.

Figure 9. Perform Payment Authority (Subprocess 3.3.6) – Level 3 Process Flow

Text version: Figure 9. Perform Payment Authority (Subprocess 3.3.6) – Level 3 Process Flow

5.5.1.1 Activities

The request for payment issuance is received by financial services (Activity 3.3.6.1 – Receive Request for Payment). The request for payment includes the justification; claim or invoice data; payment details (date invoice received, deliverables acceptance date, due date and amount payable); payee data; payment type (regular or priority payment); and financial coding block.

As part of this subprocess, the financial officer delegated payment authority pursuant to section 33 of the FAA performs quality assurance (Activity 3.3.6.2 – Perform Quality Assurance). The financial officer exercises payment authority and is responsible for certifying and ensuring that: See footnote [50]

- There is auditable evidence demonstrating that account verification has taken place and has been certified by an individual with delegated financial signing authority, pursuant to section 34 of the FAA;

- No payment is made when the payment:

- Is not a lawful charge against the appropriation;

- Will result in an expenditure exceeding the appropriation; or

- Will result in an insufficient balance in the appropriation to meet the commitments charged against it;

- When exercising payment authority:

- All high-risk transactions are subjected to a full review; and

- A sample of medium- and low-risk transactions is selected, using a sample selection methodology, and the most important aspects of each transaction are reviewed; and

- Certification of payments pursuant to section 33 of the FAA is provided to the Receiver General (Standard Payment System). See footnote [51]

If a discrepancy is identified during this process, for example a duplicate payment, the payment request is returned to the responsibility centre manager for resolution.

The department is responsible for defining high, medium and low risks based on its risk tolerance. Manage Post-Payment Verification (Business Process 8.1) describes the process of applying the quality assurance requirements of section 33 of the FAA after the payment has been made, which includes the sampling of medium- and low-risk transactions. The financial officer is responsible for requesting corrective action when a critical error is identified during the quality assurance process for payment authority. See footnote [52]

The next activity is to determine whether interest is due on the invoice and to calculate interest as appropriate, in accordance with the Directive on Payment Requisitioning and Cheque Control, using the Bank of Canada interest rate in effect for the previous month plus 3 per cent See footnote [53](Activity 3.3.6.3 – Calculate Interest).

When calculating interest on late payment of an invoice, the date to be used is the latest of the following:

- The original invoice receipt date;

- The supplier's invoice date (to be used as the default if (a) is not captured);

- The deliverables acceptance date; or

- The shipment date (to be used as the default if (c) is not captured).

Under the Directive on Payment Requisitioning and Cheque Control, if parts of an invoice are in dispute, the parts that are not in dispute are to be paid within the due date period. See footnote [54] Departmental invoice business processes should have the capacity to split supplier invoices into disputed items and non-disputed items, and to have adequate duplicate payment controls that can identify true duplicate payments versus multiple payments on the same supplier invoice.

To ensure adequate separation of duties, the following functions are kept separate when responsibility is assigned to individuals involved in the expenditures process: See footnote [55]

- Authority to enter into a contract (transaction authority): This activity is outside the scope of the Manage Other Payments business process and is performed during Manage Contracts (Subprocess 3.1.5) of Manage Procure to Payment (Business Process 3.1);

- Certification of the receipt of goods and the provision of services pursuant to section 34 of the FAA (certification authority): These activities are outside the scope of the Manage Other Payments business process and are performed during Administer Contracts and Deliverables (Subprocess 3.1.6) of Manage Procure to Payment (Business Process 3.1);

- Determination of entitlement, verification of accounts, and preparation of requisitions for payment or settlement pursuant to section 34 of the FAA (certification authority): These activities are performed during Manage Payables (Subprocess 3.3.5); and

- Certification of requisition for payment or settlement pursuant to section 33 of the FAA (payment authority): This activity is conducted during Perform Payment Authority (Subprocess 3.3.6).

If the process or other circumstances do not allow such separation of duties, alternative control measures are implemented and documented.

Furthermore, Section 6.2.2 of the Directive on Delegation of Financial Authorities for Disbursements requires that persons with delegated authority do not exercise:

- Certification authority and payment authority on the same payment; and

- Spending, certification or payment authority for an expenditure from which they can directly or indirectly benefit—for example, when the payee is the individual with financial signing authority or when the expenditure is incurred for the benefit of that individual. See footnote [56]

When the financial officer is satisfied that all requirements have been met, the payment requisition is certified pursuant to section 33 of the FAA and electronic authorization and authentication (EAA) is performed (Activity 3.3.6.4 – Exercise Authority Pursuant to FAA, section 33 (Includes EAA)).

The payment requisition is then prepared and submitted to the Receiver General (Activity 3.3.6.5 – Submit Payment Requisition to Receiver General) in accordance with the:

- Payments and Settlements Requisitioning Regulations, 1997;

- Directive on Payment Requisitioning and Cheque Control; and

- Receiver General Manual, Chapter 4 – “Standard Payment System and Departments.”

The requisitions within the payment file contain full payment details: name, date, amount, delivery address, financial institution routing information, stub detail (if required), and the type of payment. Departments assign a unique requisition number to each batch of payments. See footnote [57]

The Receiver General Control Framework and the Receiver General Manual provide additional details and steps for ensuring that the payment requisition is properly submitted to the Receiver General. Authorized requisitions can be paid using various types of payments. When selecting the type of payment, there are many characteristics to consider. See footnote [58]

Table 13 provides the relevant references as well as key characteristics of the most common types of payments.

| Type of payment | Receiver General Control Framework | Characteristics |

|---|---|---|

| Regular payment | Section 7.2 |

|

| Priority payment | Section 7.8 |

|

| Direct deposit | Section 7.2 |

|

| Large value transaction system | Section 7.7 |

|

Further details about this subprocess are provided below for the payment categories to which it applies:

Other Operational Payments

- Accountable advances: Reimbursements made through petty cash and the reconciliation of petty cash are described in Appendix E.

- Reimbursements: Because reimbursements for hospitality are often considered high-risk transactions, quality assurance is performed as part of the certification process pursuant to section 33 of the FAA.

Legal Payments

- When exercising certification pursuant to section 33 of the FAA, the financial officer ensures that appropriate documentation is obtained from subject-matter experts in compensation or legal services.

- Because legal payments are often considered as high-risk transactions, quality assurance is performed as part of the certification process pursuant to section 33 of the FAA.

Payments Not Impacting Appropriations

- Because these payments are often certified pursuant to section 34 of the FAA by financial services or corporate finance, the individual who exercises certification pursuant to section 33 of the FAA cannot the same person who exercises certification pursuant to section 34 of the FAA. See footnote [59]

- Information on deduction payments, specifically garnishments, often includes sensitive data that should be kept confidential.

Periodic Payments

- For this payment category, the subprocess is conducted in the same way as Manage Procure to Payment (Business Process 3.1).

5.5.1.2 Roles and Responsibilities

Financial services is responsible and accountable for managing payment requisitions and certifying payments pursuant to section 33 of the FAA.

Table 14 provides an overview of roles and responsibilities, using the Responsible, Accountable, Consulted, and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

| Activity | Related Data | Responsible | Accountable | Consulted | Informed | Authoritative Source |

|---|---|---|---|---|---|---|

|

Legend

|

||||||

| 3.3.6.1 Receive Request for Payment |

|

FIN | FIN | COMP, RCM | RCM | DFMS |

| 3.3.6.2 Perform Quality Assurance |

|

FIN | FIN | CF, COMP, RCM | RCM | DFMS |

| 3.3.6.3 Calculate Interest |

|

FIN | FIN | CF | RCM | DFMS |

| 3.3.6.4 Exercise Authority Pursuant to FAA, section 33 (Includes EAA) |

|

FIN | FIN | CF | N/A | DFMS |

| 3.3.6.5 Submit Payment Requisition to Receiver General |

|

FIN | FIN | N/A | RG-BCM | DFMS |

5.5.2 Issue Payment (Subprocess 3.3.7)

As illustrated in Table 15, this subprocess applies to all payment categories.

| Subprocess | Other Operational Payments | Legal Payments | Payments Not Impacting Appropriations | Periodic Payments |

|---|---|---|---|---|

| Issue Payment | Applies | Applies | Applies | Applies |

After payment authorization pursuant to section 33 of the FAA is exercised, the payment requisition is sent to the Receiver General for payment issuance. The payment requisition files are edited and validated, and the payments are released by the Receiver General. The Receiver General produces a generic return file containing unique payment references for control purposes. At this time, the payment records should be updated See footnote [60] in the departmental financial and materiel management system. Manage Other Payments (Business Process 3.3) ends, and Manage Post-Payment Verification (Business Process 8.1) or Manage Financial Close (Business Process 8.2) begins.